Phil's Playbills

Why Phil's Playbills? Well, he hates the word “blog”. Phil loves theatre, and actually reads the playbills before each performance. They are chock full of useful information, including comments by the performers. So, here are Phil's performance commentaries!

Each week you can see different commentaries either by Phil, or other financial professionals that we've reviewed and think are worthy of your time.

(July 1, 2019)

Bad Things I Have Seen – Case I

Sometimes a story cannot be told in just a few words.

I have a very elderly client who, while she lives in a retirement village, takes care of herself. She doesn’t need assisted living. That does not mean she does not need help.

This person has been with me since 1980! She also lives 500 miles away. A few years ago, I was called.

“Phil, I’ve won the lottery!”

“Really, that’s wonderful, tell me about it.”

“I’ve received a call that the money is waiting at the international airport, but they can’t deliver it until I pay the taxes as it is due to a foreign government.”

No amount of discussion could dissuade this person that this is one of the most common frauds perpetrated on the elderly. Her niece lives in the same city. I had them visit with the client. They failed to dissuade. I contacted the local FBI office as it was international. Since the crime had not yet been completed, they were no help.

I contacted the local police department. They sent 2 officers to speak with the potential victim. The head of security of the retirement village went with them. She later told me the were having a lot of problems with these fraud calls.

The real criminal here, though, was the small local bank. Every year in my profession we must take an Anti-Money Laundering (AML) update course to keep our licenses and registrations. We learn that an unusual pattern of withdrawals from an account could indicate a problem. This bank sent four wire transfers for $6,000 – $7,000 – $9,000. Totaling $36,000 in just four weeks to Costa Rica, for God’s sake!

These also were under the $10,000 reportable amounts. If we see something like this, we are supposed to notify our AML officer who files a suspicious activity report (SAR). In my opinion the bank should not have sent the wire transfers. I spoke with our general counsel and chief compliance officer, who regretfully said we had no standing to file an SAR against the bank!

I persuaded the niece to have the phone number changed to unlisted. A robo-call to a randomly generated number reached the client again. She gave them the number they called, the new unlisted number, which is now out there again!

At the time, in circumstances like this, I could not refuse an order from a client to transfer money. We now are able to freeze funds for 15 days for an elderly client where we suspect financial abuse. We report it to our Compliance Officer who contacts Elder Care Services at the State.

I finally persuaded the niece to get her aunt to move the account to a major national bank and make it a joint account with her. The majority of the client’s money was in a revocable living trust, and her niece’s husband is the successor trustee.

I felt the gullibility of a previously intelligent woman who had run her own business was evidence of a cognitive deficit. I persuaded the niece to contact the attorney who had written the trust to file for a financial guardianship. At the last minute before going to court the niece balked.

“I can’t do that to Aunt Mabel!”

“Oh, but you can let her be ripped off by thieves?”

I started writing this 3 months ago. Many things have intervened to prevent it being finished. By the time I had gotten back to finish this playbill, the aunt called me because she needed more cash. I could not get her on the phone so I had the young lady go over there to get her on the phone with me.

“Phil, I’ve won $4 million but they need $50,000 to pay the taxes before they can send it because the money is overseas”

“Put your niece back on the phone”

Me to young relative:

“Your aunt is still at risk. But this time I will refuse to transfer the money to your local bank, freezing the account for 15 days while my compliance officer contacts Elder Care Services, and you can explain to them why you have not moved to protect your aunt.”

This story is still not over.

Do YOU know what is going on with your elderly relatives?

(June 25, 2019)

Bad Things I Have Seen – An Introduction to a Series

My goal in sharing these ideas is twofold. First, educational, to help you learn things you may not know. Second, cautionary. By sharing real stories that have happened to my clients or people I know, it may save you or someone you love or care about from the same untold result.

If you see yourself in one of these stories, know your anonymity has been ensured. I hope you do not feel uncomfortable recognizing yourself. Please take comfort in knowing your misfortune may save your fellow person from the same.

One type of story involves seeking advice after it is too late to solve the problem. I try to get my nominators to understand that if they care about or love someone, encouraging that person to sit down with a planner can often uncover issues that can be addressed while there is still time.

The good news is some of the stories have good outcomes because through fact finding a good planner does will often share a new and valuable idea with you. My clients come almost exclusively from referrals. That does not mean I do not welcome inquiries from my readers audience. Please contact me.

It has been suggested these posts are too long. I am addressing things that are not necessarily simple. I think a discussion is better than a headline. Just like National Public Radio. I will end here and let each story itself tell the bad things I have seen.

See you next time.

(June 19, 2019)

Financial Planning & Investing Myths – An Introduction to a Series

This series will focus on what is often referred to as conventional wisdom. Not!

- Is a home mortgage a great thing to have because of the tax deduction?

- If you stay in the stock market for 10 years you can’t lose money.

- When stocks go down, bonds go up. When stocks go up, bonds go down.

- When markets go down you should get out.

- I’ll wait to sell until it goes back up again. This last one will be the first story I share with you.

And many more….

I would especially appreciate suggestions on your own investing or planning myths that I can share with our audience. Thank you.

(June 12, 2019)

Portfolios: Time Horizons & Liquidity

Everyone hears about diversification. You’re told you need to do it. But why? Because different assets will perform differently at different times under different economic conditions. To help my clients see this I use the Callan chart. Here is the link.

https://www.callan.com/periodic-table/

So, in any portfolio, some positions will make money; some positions will lose money. Why does this matter? Investing is not done for its own sake (I hope). It is done to serve human needs, to fund your goals and plans. Every financial goal has a time horizon. Your kids going to college, your retirement, anything. I think this is the most important parameter that is not sufficiently emphasized.

Life Insurance companies exercise asset matching to their liabilities. They know the likely number of claims that will occur each year. So, they see to it that enough assets will mature each year to pay those claims. They must insure liquidity. Liquidity is having enough assets that can be sold without a loss of principal to cover a liability or a need when it occurs.

I recollect that all the securities exams I have taken to be registered had questions on the importance of two things: inflation, or purchasing power risk, (look back at the stamp inflation example) and the time horizon of your investments when they need to be liquid.

So, before you build a portfolio, write out a horizontal timeline on a spreadsheet and note the liquidity time points and their amounts.

There is no guarantee that a diversified portfolio will enhance overall returns or

outperform a non-diversified portfolio. Diversification does not protect against market risk.

(May 22, 2019)

Recommended Reading

I am regularly asked to recommend books on investing. As a former academic, I read plenty of technical material. My partner warned me to keep it on a simple level. So here is an attempt.

The first recommendation may sound self-serving: this website. I have tried to provide an archive of newsletter articles that are short and simple. The second recommendation is definitely not self-serving: join the American Association of Independent Investors. I have and read their magazine religiously (Whoops! Questionable description in our current atmosphere) every month. Most people do not have the time or inclination to do their own investing. The more clients understand portfolio management principles, the easier my job will be. I don’t think it will reduce the number of people asking me for help.

Then there is Michael Lewis. I introduced Kahneman and Tversky in the context of Destructive Investor Behavior. Kahneman won the Nobel in Economics for laying the groundwork for Behavioral Finance. I recently read Lewis’s “Undoing Project” about them. Before that I’ve read “Liar’s Poker” and “The New New Thing”. He spoke at a Pershing Insite (Investment) Conference while writing “The Big Short”. He was stunned at what he was discovering while writing the book. Next on my list: “The Flash Boys” and “Panic – The Story of Modern Financial Insanity”. He wrote “Moneyball”, about applying statistics to choosing baseball players, and the movie of the same name. So, yes, pretty much anything by him.

The next book, “One Up on Wall Street”, is from 1995 by Peter Lynch, creator of the famous Fidelity fund Magellan. I am guided by many of his principles. There is also the Princeton Economist Burton Malkiel’s “A Random Walk on Wall Street”. While I do not agree with much of its ideas, it is a very important book, a milestone in its own right.

I cannot recommend any book on personal financial planning. At least one idea is sufficiently damaging to offset the good that would come from the rest of the book. I have not read them all. Please send me YOUR recommendations. It has been suggested to write my own. Sorry, no time.

Let me share a story about that. My first invitation to attend a due diligence meeting at PIMCO’s Newport Beach, CA headquarters was in 2004 ( It is not possible describe how exciting it was to receive that invitation). We were in the conference room. Curtis Mewbourne, a portfolio manager and managing director, was talking about emerging market investments. At the time he was also writing their monthly “Emerging Markets Watch”. An attendee (all of us were registered representatives, i.e. securities people) was being quite unpleasant towards Curtis about how bad those investments had worked in his portfolios. I sensed the rep had over-allocated to them, chasing gains. Curtis answered with several reasons they were important to have in a portfolio. I raised my hand. He called on me.

“Mr. Mewbourne, in last month’s Emerging Markets Watch, you also said….”

He laughed out loud. When he saw the bemused look on my face, he said,

“I have often wondered if any of you read what we write!”

I thought of writing this as a separate playbill. If any of you have read this far, any responses will have validity. I barely have the time to write these as it is. If you are reading these, enjoying them, benefiting from them, PLEASE let me know. Or maybe I will need to face facts and stop wasting my time.

Well, are any of you reading these?

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk.

(May 8, 2019)

The Most Useful Financial Planning Tools I Know

It is called the Rule of 72. Its sister is the Rule of 115. From Investopedia again: “The Rule of 72 is a simple way to determine how long an investment will take to double given a fixed annual rate of interest. By dividing 72 by the annual rate of return, investors obtain a rough estimate of how many years it will take for the initial investment to duplicate itself.” The rule of 115 gives you the tripling numbers.

Using this, my client and I can get very close to the broad diameter of a given financial goal. Let's say that in 10 years you expect to need to replace your car, and you have enough resources to pay cash, and want to pay cash. You estimate it will cost $60,000. Well, maybe you could get a Tesla for that now, but not in 10 years! Just an example.

If you can set aside $30,000 for the 10 years, divide 72 by 10 years. You will need to earn 7.2% annually. I frankly consider that a high after-tax return going forward. You now know, however, that $30,000 is not quite enough to meet the goal.

Say you assume you can only earn 6%. Then divide 72 by 6 and it will take 12 years for an investment to double, so you would need to put away more than $30,000. We clearly have more powerful tools to calculate how much is necessary to meet your goals under different scenarios of invested amount and time and return. But I have found these rules to be of extraordinary help in the initial discussions with clients on meeting goals. I hope this helps.

The Rule of 72 is a mathematical concept and does not guarantee investment results nor functions as a predictor of how an investment will perform. It is an approximation of the impact of a targeted rate of return. Investments are subject to fluctuating returns and there is no assurance that any investment will double in value.

(May 1, 2019)

The Postcard - Part 2

I reconnected with BG, the now recording engineer and his wife. A couple of years later his wife inherited a couple of oil wells in Michigan. BG wanted to open his own voice over recording studio. He knew nothing about business and asked me for my guidance. This was the beginning of my clientele in music industry.

In 1994, a client in the entertainment world in New York City asked me to come there to help a young actress he was living with who had come into some money. Now that I was licensed for insurance and registered for securities in New York state, I realized there was a great opportunity there. I asked for referrals from my clients in Miami to the recording studios there.

While I was preparing for the first foray up North, BG said to me,

“What makes you think you can go up there and just walk into recording studios?'

“Look at who my clients are? With referrals!” I responded.

“Look at yourself!” BG laughed.

“What are you talking about?” I responded with dismay.

“In the mirror” he said, pointing. “You're straight!”

“I am not!” I insisted.

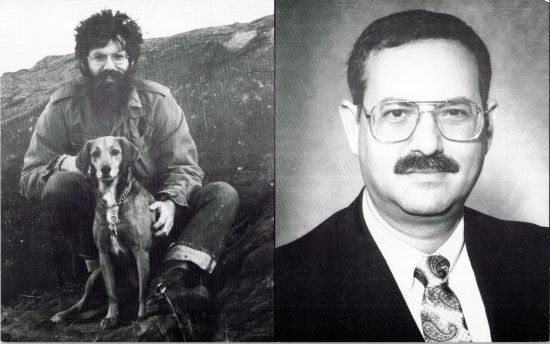

“Short hair, no beard, suit and tie? Yeah, right. WE knew you when you were COOL in the 60's!” BG said with a smirk on his face.

On the drive back to Tallahassee, the idea for the postcard sprung to mind full blown, like Aphrodite from the sea foam. I had a great printer who helped me put it together. I then had my nominators write a personal note on the postcard to the referrals in NYC. I mailed it ahead. I called and made appointments. When I got to a studio, I held the postcard up to the peephole. The door would open, a hand would reach out and grab me by the tie, and as I was pulled into the studio they yelled out,

“Hey, it's the guy with the dog on the postcard.”

Yep, the dog. I daresay that postcard is still taped to a lot of refrigerators or on bulletin boards or walls in a lot of recording studios in NYC.

(April 24, 2019)

Destructive Investor Behavior - Introduction

First, an apology. Blogs are normally light in style. Many of mine are going to be a bit on the academic side, not light reading at all. I was an academic in two distinct fields of study in an earlier life. I still think of myself as an academic. My goal in writing these commentaries is in fact educational. Feel free to skip one if it seems to bog down. But do please tune in the next week. Most will be, I hope, at least a bit entertaining. Thank you. Oh, yeah, this one is a bit heavy, so you might want to tune in for the next three weeks when I share three actual instances of Destructive Investor Behavior that cost them real money.

The Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel was established in 1968 by the Bank of Sweden. It was first awarded in 1969, more than 60 years after the distribution of the first Nobel Prizes. Although not technically a Nobel Prize, as it was not part of Alfred Nobel's original endowment (the X prize of his day), it is identified with the awards. Its winners are announced with the Nobel Prize recipients. It is presented at the Nobel Prize Award Ceremony. It is conferred by the Royal Swedish Academy of Sciences in Stockholm. Three of its recipients have been pioneers in the field of Behavioral Economics and Finance.

It has been said that the Investor is their own worst enemy. The founding of behavioral economics addresses this. It can be traced to two Israeli (later American) psychologists, Amos Tversky and Daniel Kahneman. Kahneman was awarded the Economics prize in 2002 for his integration of psychological research into economic science, especially concerning human judgment and decision-making under uncertainty. I am often asked if there is a book on investing I can recommend. Most books have at least one idea with which I take so much issue I cannot recommend them. Anything by Michael Lewis is worthwhile. He just published “The Undoing Project”, about Tversky and Kahneman. It will teach you a lot about your own unconscious biases.

In 2013 it was awarded to Robert J. Shiller of Yale University for his research on the variability of asset prices and on the underlying rationality (or irrationality) of financial markets. Shiller in particular was honored for work in which he showed that variations in the prices of stocks and bonds over long periods occur in predictable patterns that reflect the irrational expectations of investors regarding the value of future returns. Shiller is credited with the first use of the phrase Irrational Exuberance, used by Alan Greenspan without attribution in the late 1990's during the internet stock market boom. Shiller published a book entitled “Irrational Exuberance”. Most people will know of him from the Case-Shiller Home Price Index quoted on the news all the time (Dr. Case is of Dartmouth University).

In 2017 the Nobel Prize in Economics was awarded to Richard H. Thaler of the University of Chicago Booth School of Business for his contributions to behavioral economics, for "incorporating psychologically realistic assumptions into analyses of economic decision-making. By exploring the consequences of limited rationality, social preferences, and lack of self-control, he has shown how these human traits systematically affect individual decisions as well as market outcomes."

The next three posts will be actual instances where irrational behavior on the part of investors led to a monetary loss. See you next week.

(April 17, 2019)

The Postcard - Part 1

Left: Phil Spitzer, 1973; Right: Philip R. Spitzer, CLU, ChFC, 1993

This post will be a bit different than the usual investing thoughts or educational ideas that I share here. This is more personal. It is for fun. My team asked if this would not just be better as a post on a personal site. I explained that people don't only seek a competent advisor who has the skills and services they need. They also look for someone they can relate to. As I would love to have more clients interested in socially responsible investing, I think this will appeal to my kind of people. It will be told in two parts. It will explain how the postcard came to be!

I was born in Brooklyn, but in the 50's there was a mass migration to Miami, and that is where I grew up. In the 60's Coconut Grove in Miami was Greenwich Village South, with the famous Gaslight South Coffee House. I was a fan of folk singing.

Between college years I worked on a research team in the Everglades from 1967 to 1969, the Hydrobiology unit of the US Geological Survey, Department of the Interior. When I left the research team, I became a full-time environmental activist for the next two years before returning to college in 1971. I felt that we had all the knowledge we needed to save the Earth. All we needed was the political will to act on it. Remember, this was before we succeeded in passing the Clean Air Act and the Clean Water Act.

I thought the folk singers were cool because they were folk singers. They thought I was cool because I was saving the Earth. I was recruited to help found Earth Day. Organizing the observance in Miami that first Earth Day was wonderful. Miami Dade Community College hired me to create an environmental education program called Man and His Environment. A politician I had helped with his campaign for city commission in Miami proposed to the commission that they create the Environmental Research Advisory Council. They agreed. He recruited an architect, a landscape architect, an environmental law professor, and me as the ecologist. There were many other efforts locally and nationally during those two years that I was involved in.

In 1968 a business friend of my Dad's hired me to help him open up a coffeehouse across from the famous Flick, on US 1, Dixie Highway, next to the University of Miami. When I was at Florida State University, I helped create the Club Down Under music venue in 1972. I booked the acts. The opportunity to create these music venues further cemented my relationships with many of the folksingers of the day.

The picture on the left was me with my dog Lady when I was going to Boston University in 1973 as a doctoral candidate in Anthropology. After I came back to Miami, Gamble Rogers, an iconic Florida bard, was fronting the Nitty Gritty Dirt Band at an outdoor concert put on in 1976 by the Performing Arts for Community and Education organization. So, after the concert Gamble is packing up his guitar. He sees this straight looking guy (clean cut, that is) coming across the field straight at him. He gave me a quizzical look. When I was within hearing, I said:

“Don't even try to guess who it is! It's Phil Spitzer!”

“What happened to YOU, man?”

I asked how he was getting home to St. Augustine. He said he was flying. I then asked how he was getting to the airport. He had not figured that out yet. Since there was enough time before his flight, I said let me take you to dinner so we can catch up.

At this point, I need to explain why some actors in the story will be unnamed. The Investment Advisors Act of 1940 regulates advisors like me who charge fees for advice and management of assets. Advisors who have a fiduciary relationship with clients cannot use promotional references to get business. It would not be “fair and balanced” unless I also listed the folks who were NOT satisfied with my work and left me. If I was purely compensated by commissions, I could list the many well-known clients I have had in the music, entertainment and recording industry, but the ACT forbids me from doing so.

While we were at dinner I asked about another folk singer, BG (who will remain unnamed because he later became a client).

“Does BG still live here? Is he still performing?”

Gamble said yes, he still lived in Miami, but was working in a recording studio.

“Making albums?” I asked.

“No, making radio commercials.”, Gamble replied.

“BG is making radio commercials!” I responded in a shocked manner.

“Hell,” Gamble said, “You're selling insurance!”

And it dawned on me. The 60's were over.

Tune in to my posts two weeks from now when I will explain how the postcard came to be.

(April 10, 2019)

Everybody Talks About Inflation, but...

how many people really understand it? Investopedia is an excellent website to find financial definitions.

They say:

“Inflation is a quantitative measure of the rate at which the average price level of a basket of selected goods and services in an economy increases over a period of time. It is the constant rise in the general level of prices where a unit of currency buys less than it did in prior periods. Often expressed as a percentage, inflation indicates a decrease in the purchasing power of a nation's currency.”

THAT is the really important part. Inflation erodes your purchasing power. Using the Rule of 72 (discussed in a future post; meantime find it on the internet), if inflation is just 4%, then in 18 years your dollar buys half as much. From an investment and portfolio management standpoint, this means that if you wish to maintain your portfolio's value, it needs to earn and reinvest 4% IN ADDITION to the amount you withdraw.

According to the Bureau of Labor Statistics Consumer Price Index (“CPI”), prices in 2017 are 1,261.78% higher than average prices in 1945. The dollar experienced an average inflation rate of 3.69% per year during this period. That is quite close to 4%. During this time we have had the moderately low inflation of 2% annually now and as much double digit inflation in the late 1970's.

My clients know I am a philatelist (postage stamp collector) because the mail they receive from me is covered with old US postage stamps. For many years I was also a professional stamp dealer and a member of the American Stamp Dealers Association. I have found one of the best ways to dramatically demonstrate inflation is the increase in the cost to mail a first class letter. From 1965 to today that has gone from 5 cents to 55 cents, as illustrated below. This is an inflation rate of 4.56% annually.

If you like this, I can send you a card with six stamps illustrating the increase in postage decade by decade from 1950 to 2000. Just send me your snail mail address and a request. Please give me time to prepare it for you and for it to arrive. Thanks.

The Rule of 72 is a mathematical concept and does not guarantee investment results nor functions as a predictor of how an investment will perform. It is an approximation of the impact of a targeted rate of return. Investments are subject to fluctuating returns and there is no assurance that any investment will double in value.

(April 3, 2019)

My Best Investment Advice

I recently reconnected with an old friend from my Florida State University days. He was in Tallahassee last year. He was honored by his undergraduate major department as one of their most successful graduates. He gave a reading from one of his works at a local bookstore. I surprised him by showing up unannounced.

“Spitzer!? Is that you?!”

We have seen each other regularly since then. At dinner in February, his wife asked me for my best investment advice. My answer?

Act, Don't React

If you structure your portfolio with liquidity needs in mind (access to funds without loss), the time horizon for those needs, and adequate diversity for working towards your goals (cash or equivalents, fixed income, equities, non-correlated alternative assets, and so forth), then when markets decline there is the potential for you to sail through them.

We speak of reversion to the mean. Over time market indicators, such as the Dow Jones Industrial Average, have historically recovered. There is no guarantee that will occur in the future though. According to this article on Investopedia, portfolios that have not sold out after a decline but have remained fully invested historically have done better than those that have tried to time the market.

The bottom line here is, to quote a slogan of the Prudential Insurance Company's from many years ago:

"The Future Belongs to Those Who Prepare For It!"